Get the free self employed tax deductions worksheet

Show details

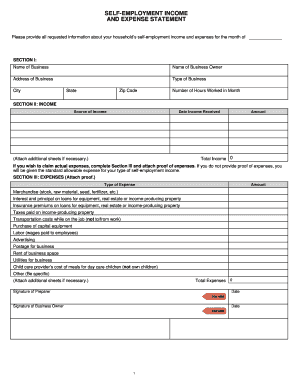

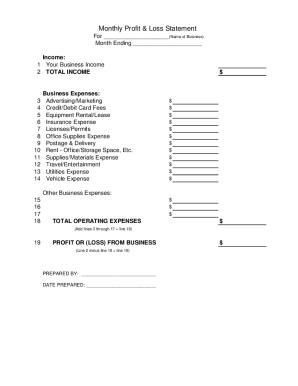

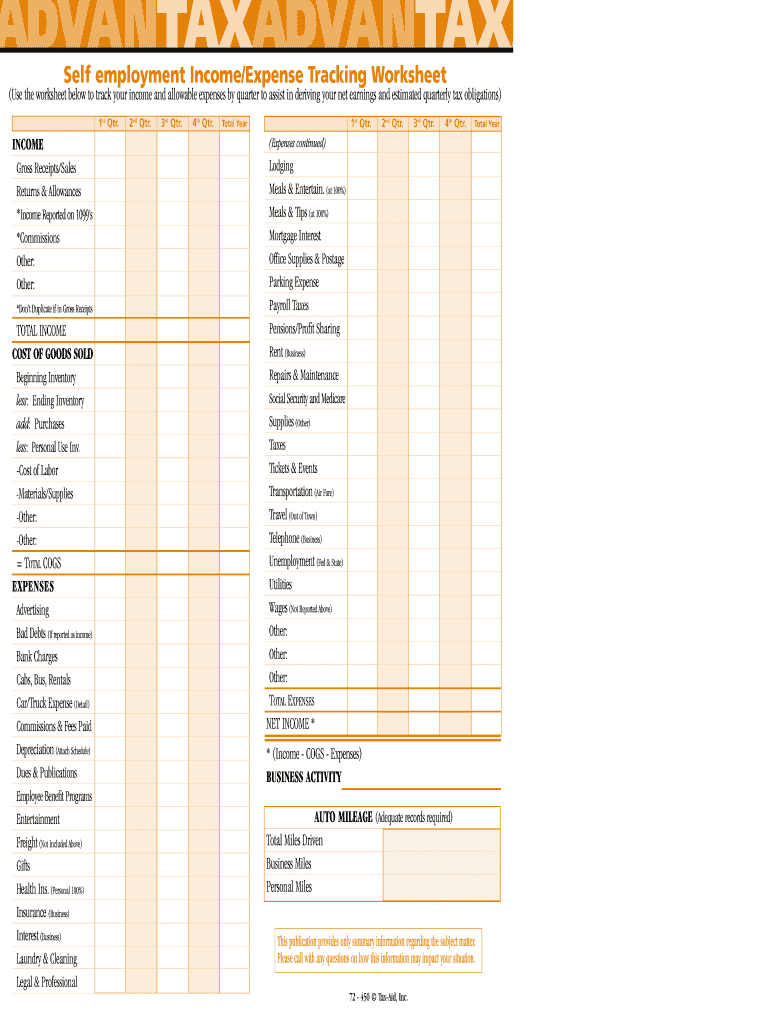

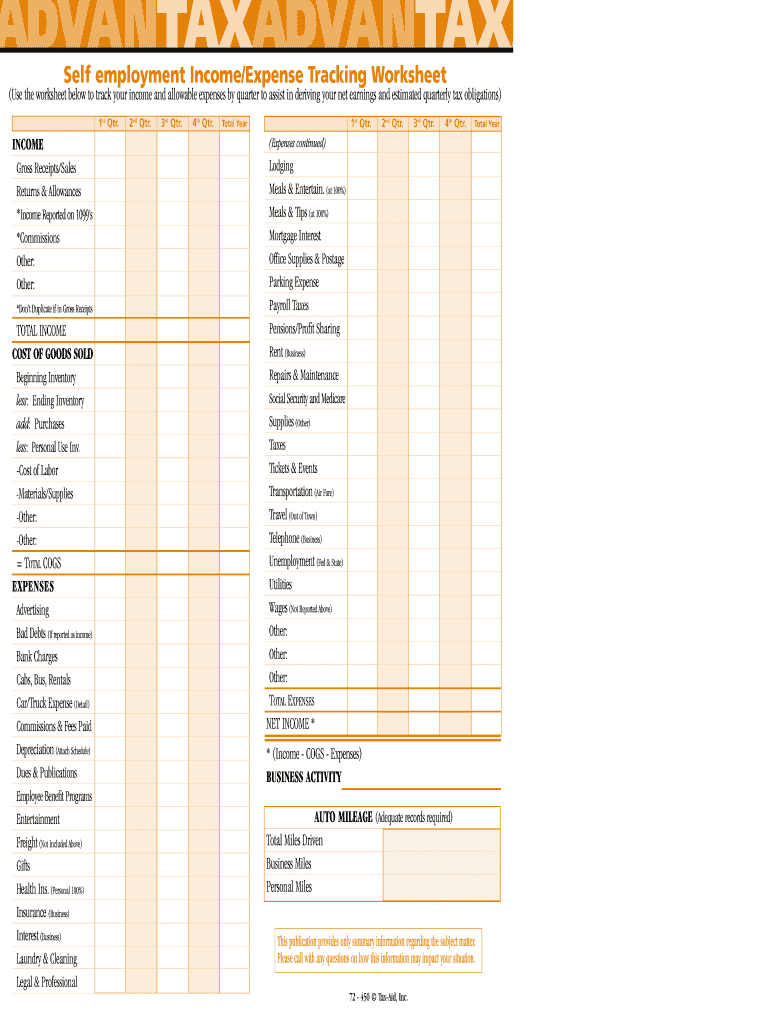

ADVANTAXADVANTAXADVANTAX Self employment Income/Expense Tracking Worksheet Use the worksheet below to track your income and allowable expenses by quarter to assist in deriving your net earnings and estimated quarterly tax obligations 1st Qtr. INCOME Gross Receipts/Sales Returns Allowances Income Reported on 1099 s Commissions Other Don t Duplicate if in Gross Receipts TOTAL INCOME COST OF GOODS SOLD Beginning Inventory less Ending Inventory add P...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self employed expense small business spreadsheet for income and expenses form

Edit your small business spreadsheet for income and expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employed tax deductions worksheet pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self employed tax deduction worksheet online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit self employed business expenses worksheet form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business spreadsheet for income and expenses xls download form

To fill out self employment income expense, follow these steps:

01

Gather all relevant financial documents, such as invoices, receipts, and bank statements.

02

Calculate your total income from self-employment by adding up all the amounts received.

03

Deduct any eligible business expenses from your total income to determine your net income.

04

Categorize your expenses into various expense categories, such as office supplies, travel expenses, or advertising costs.

05

Fill out the appropriate sections of the self-employment income expense form, providing accurate and detailed information about your income and expenses.

06

Keep supporting documents and receipts as proof of your income and expenses for future reference.

Who needs self employment income expense?

01

Self-employed individuals who earn income from their own business or freelance work.

02

Independent contractors who perform services for different clients.

03

Entrepreneurs who operate small businesses or start-ups.

04

Professionals who work on a freelance basis, such as photographers, writers, or consultants.

05

Anyone who is not employed by a company but generates income through self-employment activities.

Fill

excel spreadsheet for small business income and expenses

: Try Risk Free

People Also Ask about business income and expense worksheet

How do I make an Excel spreadsheet into personal expenses?

How to Create a Budget Spreadsheet in Excel Identify Your Financial Goals. Determine Your Budget Period. Calculate Your Total Income. Begin Creating Your Excel Budget. Enter All Cash, Debit and Check Transactions Into the Budget Spreadsheet. Enter All Credit Transactions. Calculate Total Expenses From All Sources.

How do I create an income expense sheet in Excel?

Follow these simple steps to create your next income and expenses spreadsheet in excel: Open your Excel worksheet and select one column for income and another for expenses. Record all your income and expenses in their respective column. Select the last cell in your income column, type "Total income," and press 'Enter.

How do I keep track of business expenses and income in Excel?

If you want to track business expenses in Excel, you'll need to create a spreadsheet and fill in the appropriate information. The most important columns are likely to be “date,” “description,” “category,” and “amount.” You can also add additional columns if needed, like “vehicle number” for tracking car expenses.

How do I create a spreadsheet to track expenses?

A spreadsheet that keeps track of expenses can serve as a ledger. Use the top row of each column for the categories you've defined. Use the far left-hand column for the date, and the column second to the left for the name of the vendor. Enter the amount of each expense in the column that corresponds to its category.

How do I keep track of income and expenses when self employed?

A self-employment ledger, or “tax ledger”, is a fancy expression to describe where you keep track of all your business income and expenses – just your standard bookkeeping! You can document in an online spreadsheet, accounting software, or handwritten “ledger” book.

How do you make an expense tracker spreadsheet?

Implementation Steps Fig 1 – Expense Tracker Columns. Now, we will turn these columns into tables with all alternating rows. Fig 2 – Format as Table. Fig 3 – Table Headers Checkbox. Fig 4 – Expense Table. Fig 5 – Date Column. Fig 6 – Date Formatting Option. Fig 7 – Date Format Cells. Fig 8 – Auto Month filled ing to Date.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the income and expense worksheet excel in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your self employed deductions worksheet and you'll be done in minutes.

How can I edit self employment income and expense statement pdf on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing self employed expense worksheet right away.

How do I complete business income and expense worksheet excel on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your spreadsheet for income and expenses by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is self employment income expense?

Self employment income expense refers to the costs incurred by an individual in the course of running their own business. These expenses can include office supplies, equipment, travel, and other necessary expenses related to generating income.

Who is required to file self employment income expense?

Individuals who earn income from self employment, such as freelancers, independent contractors, and small business owners, are required to file self employment income expense to report their earnings and claim allowable business expenses.

How to fill out self employment income expense?

To fill out self employment income expense, an individual should gather all relevant financial documents, list all income earned, calculate total expenses, itemize each expense, and report them on the appropriate tax forms, typically Schedule C (Form 1040) in the United States.

What is the purpose of self employment income expense?

The purpose of self employment income expense is to accurately report income and expenses related to self employed activities for tax purposes, allowing individuals to determine their taxable income and claim deductions to reduce their overall tax liability.

What information must be reported on self employment income expense?

The information that must be reported includes total income received from self employment, a detailed list of business expenses incurred, the nature of each expense, and any other relevant financial information that supports the income and deductions claimed.

Fill out your self employed tax deductions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Employment Income Expense Tracking Worksheet Excel is not the form you're looking for?Search for another form here.

Keywords relevant to self employment tax deductions worksheet

Related to small business income and expense excel template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.